Ultimate Guide to Farming Perp DEXs: Limit Orders, Liquidation Dodges, and Low OI Plays

Unlock airdrop potential with smart strategies for perp DEX farming: optimize limit orders, manage liquidation risks, target low open interest assets, and spotlight top platforms like Lighter, Extended, Pacifica, and Variational.

Perpetual futures DEXs (perp DEXs) are exploding in 2025, with monthly volumes topping $1.5 trillion and points programs turning trades into airdrop goldmines. But farming isn't just about spamming volume—it's about smart, sustainable strategies that minimize losses while maximizing rewards. Whether you're a degen scalper or a cautious accumulator, this guide breaks down limit orders for rebates, liquidation-proof risk management, and low open interest (OI) opportunities.

We'll cap it with our top picks: Lighter, Extended, Pacifica, and Variational. Remember: Perps are high-risk—trade what you can afford to lose, and always DYOR.

Perp DEX Farming 101: The Basics Before You Dive In

Farming on perp DEXs means generating trading volume, providing liquidity, or hitting milestones to earn points redeemable for tokens at TGE. Most platforms reward genuine activity over wash trading, with anti-Sybil measures like tiered boosts for consistent users. Start small: Deposit USDC or stables, connect a wallet (e.g., Phantom for Solana, MetaMask for EVM), and track points via dashboards. Pro tip: Use referrals for 5-15% bonuses, but diversify across 3-5 DEXs to hedge TGE delays. Tools like Dune Analytics or platform explorers reveal leaderboards—aim for top 10% with $1K-5K capital.

Mastering Limit Orders: Rebates, Precision, and Volume Without the Burn

Market orders are quick but costly—taker fees (0.02-0.05%) eat into your farm budget. Limit orders flip the script: Place buys/sells at specific prices to become a maker, earning rebates (up to 0.02%) that offset gas and compound your points.

Why Limits Rule Farming

- Rebate Efficiency: On platforms like Extended, makers get 100% fee rebates on high-volume weeks, turning $10K volume into free points multipliers.

- Slippage Shield: In volatile markets, limits prevent overpaying during pumps/dumps—key for low-OI assets.

- Farming Hack: Sandwich trades: Enter with a limit long, exit with a limit short at a tight spread (1-2 ticks). This racks volume with minimal exposure.

Pro Tips

- Post-Only Mode: Use on Lighter or Variational to ensure maker status—cancels if it would fill as taker.

- TWAP/Scale Orders: Extended and Pacifica offer time-weighted average price orders to drip-feed volume over hours, mimicking organic trading.

- Bracket with TP/SL: Attach take-profit/stop-loss to limits for automated farming—Variational's drag-and-drop UI shines here.

Start with 5-10x leverage on majors like BTC/USD; scale to 20x on alts once comfortable. Track: A $500 position cycling 20x daily yields $10K volume with <1% risk per trade.

Navigating Liquidations: Risk Management to Keep Your Farm Alive

Liquidations wipe positions when collateral dips below maintenance margin (typically 0.5-2% of notional). In farming, they're the silent killer—high leverage amplifies points but invites bots to hunt stops. Aim for survival over moonshots.

Key Defenses

- Leverage Caps: Stick to 5-10x for farming; 20x+ only on hyper-liquids like ETH. Variational's partial liquidation engine closes 10-20% of positions incrementally, buying time.

- Margin Monitoring: Use cross-margin (shared across positions) on Pacifica for efficiency—isolated per trade limits cascade risks.

- Stop Strategies: Trailing stops on Extended adjust dynamically; set 2-5% below entry to exit before liq price (calc: Entry / (1 + Leverage * Maintenance Margin)).

- Buffer Builds: Maintain 150% initial margin. Tools like Pacifica's AI bots auto-adjust based on volatility.

Real Talk: During October 2025's flash crash, Lighter users with <10x leverage lost 0% to liqs, while over-levered farms tanked 50%+. Simulate on demo modes first—Extended's is gold for practice.

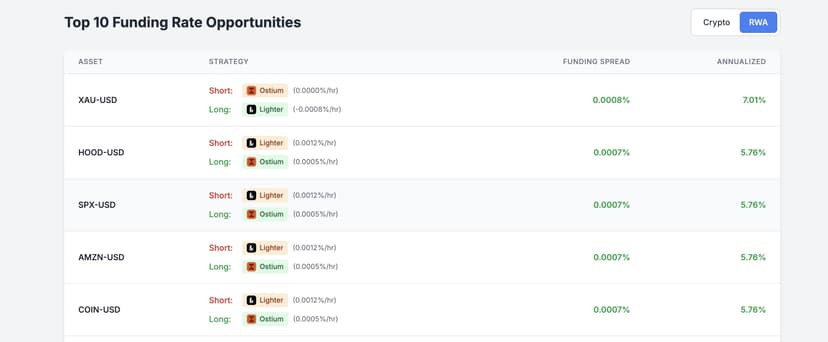

Trading Low Open Interest Assets: Volatility Plays for Point Multipliers

Low OI markets (<$1M) mean thinner books but outsized rewards: Many DEXs (e.g., Lighter's Season 2) give 1.5-2x point boosts for "emerging" pairs, as they drive listings. These are pre-launch tokens or niche alts—high vol for quick flips, but watch slippage.

Spotting and Trading Low OI Gems

- Hunt via Dashboards: Filter for OI <500K on Variational or Pacifica; targets like $PAXG (gold perp) or meme futures yield 2-3% moves hourly.

- Entry/Exit Tactics: Use limits 0.5-1% off spot for fills; market orders only in breakouts. Scale in: 25% position per leg to average down.

- Risks & Rewards: 50x leverage possible, but 10% swings liq fast—pair with hedges (short BTC on high OI). Farmers report 3x points vs. majors with 20% more vol per dollar risked.

- Pacifica Edge: New $PAXG listing at 10x—low OI gold exposure without TradFi gates.

Pro Move: Rotate weekly—$100K OI today becomes $1M tomorrow, diluting your edge. Track via DefiLlama for fresh pairs.

Top Perp DEXs to Farm Right Now: Where the Points Flow

With TGEs looming Q4-Q1 2026, these four stand out for low competition, high yields, and farmer-friendly features. Diversify: $1K each for balanced exposure.

Lighter (Ethereum L2)

Post-mainnet launch, Season 2 drops 250K points weekly via volume and LLP stakes. ZK-proof trades, zero retail fees—farm BTC/ETH at 20x with API bots. TVL: $816M; edge: 150% YTD LLP yields. App: app.lighter.xyz. Why farm? Early beta holders at 1M+ points; TGE by Dec 2025.

Extended (Starknet)

$1B daily vol, 1.3M points weekly in Season 1—merit-based for makers/referrals. TradFi pairs (EUR/SPX) at 100x; Vault LP for rebates. Recent: 300K compensation drop. App: app.extended.exchange. Why farm? Unified margin incoming; top 300 needs just $50K vol.

Pacifica (Solana)

The sleeping giant: $33B cumulative vol in closed beta, 500K points weekly—unvolumed, with 500U farming TOP 300. Off-chain CLOB + AI bots, partial liqs; self-funded by ex-FTX COO. New: TWAP, $PAXG perps. Invite-only: app.pacifica.fi (grab a ref on X). Why farm? No VCs, community-first; Solana speed at CEX levels.

Variational (Arbitrum)

Zero fees + $1M loss refunds make it rebate heaven; pre-points beta with volume ties to $VAR airdrop. OLP yields 500% APY; tiered odds up to 12% on refunds. App: omni.variational.io. Why farm? Lottery-style rebates turn losses to wins; 50% tokens for community.

Farm Smart, Not Hard: Final Thoughts

Perp farming blends skill and patience—prioritize limits for rebates, buffers against liqs, and low OI for multipliers to turn $5K into six-figure airdrops. Monitor X (@Lighter_xyz, @extendedapp, @pacifica_fi, @variational_io) for drops, and use wallets like Rabby for multi-chain ease. Risks? Volatility, rugs, regs—start with 1% portfolio allocation.

Ready to swim with the big fish? Pick a DEX, snag a referral, and trade on. What's your first farm play?

Stay tuned to our blog for more DeFi strategies and airdrop alerts.