Hyperliquid: The All-in-One Blockchain for Finance

Explore Hyperliquid, a high-performance blockchain designed specifically for financial applications with its premier decentralized exchange and developer ecosystem.

Hyperliquid represents a paradigm shift in decentralized finance by offering a purpose-built blockchain designed specifically for financial applications, with its flagship decentralized exchange leading the way.

Official Links:

- Hyperliquid Exchange - Start trading on the flagship decentralized exchange

- Hyperliquid Documentation - Comprehensive guides and API references

- Hyperliquid Stats Dashboard - Real-time metrics on trading volume, users, and network performance

What is Hyperliquid?

Hyperliquid is a specialized Layer 1 blockchain designed to unify fragmented financial applications in the crypto ecosystem. Unlike general-purpose blockchains, Hyperliquid optimizes for financial use cases with high performance, low latency, and transparent on-chain operations.

Key Statistics:

- Block Time: 0.07 seconds

- Active Users: 475,000+

- Maximum TPS: 200,000

- Daily Trading Volume: $4.1B+

The Hyperliquid Architecture

The Hyperliquid ecosystem consists of several interconnected components:

HyperBFT Consensus

The foundation of the Hyperliquid blockchain, allowing a decentralized set of nodes to reach consensus on the state of the network with extremely fast finality.

HyperCore

A high-performance execution environment optimized for financial primitives like order books, perpetual futures, and spot trading.

HyperEVM

A general-purpose execution environment compatible with Ethereum tooling, allowing developers to build applications that can interact with HyperCore's financial primitives.

The Flagship Decentralized Exchange

Hyperliquid's premier application is its fully on-chain decentralized exchange, offering:

Key Features:

- Fully On-Chain Order Book: All orders, trades, funding payments, and liquidations occur transparently on-chain

- Zero Gas Fees: Users pay no gas fees for placing or canceling orders

- Low Trading Fees: Competitive fee structure compared to both centralized and decentralized alternatives

- Up to 50x Leverage: Trade perpetual futures with high capital efficiency

- One-Click Trading: Streamlined trading experience without constant wallet approval prompts

- Cross-Collateral: Use multiple assets as collateral for trading positions

Markets Available:

- Major cryptocurrencies (BTC, ETH, SOL, etc.)

- Emerging altcoins

- Synthetic assets and indices

Getting Started with Hyperliquid

Trading on Hyperliquid

To begin trading on Hyperliquid, visit the official trading platform.

Step 1: Connect to Hyperliquid

Visit the Hyperliquid exchange and connect using Metamask.

Step 2: Fund Your Account

Deposit crypto assets from Arbitrum.

Step 3: Start Trading

Navigate the intuitive interface to:

- Place market or limit orders

- Set leverage levels (up to 50x)

- Utilize advanced order types (stop-loss, take-profit, etc.)

Building on Hyperliquid

Developers can leverage Hyperliquid's infrastructure to build applications by referring to the developer documentation:

- Trading Bots: Interact with the order book via API

- Analytics Tools: Access transparent on-chain data

- DeFi Applications: Create lending, yield, or structured products using HyperEVM

- Custom Financial Instruments: Design and launch unique trading products

The HYPE Token and Ecosystem

Hyperliquid's native token, HYPE, plays a central role in the ecosystem:

HYPE Utility:

- Governance: Vote on protocol parameters and upgrades

- Staking: Secure the network through staking and validation

- Fee Sharing: Earn a portion of network fees proportional to stake

Community-First Approach:

- No venture capital investors

- No paid market makers

- Network fees do not go to any company

- Fully community-owned and operated

Advanced Trading Strategies on Hyperliquid

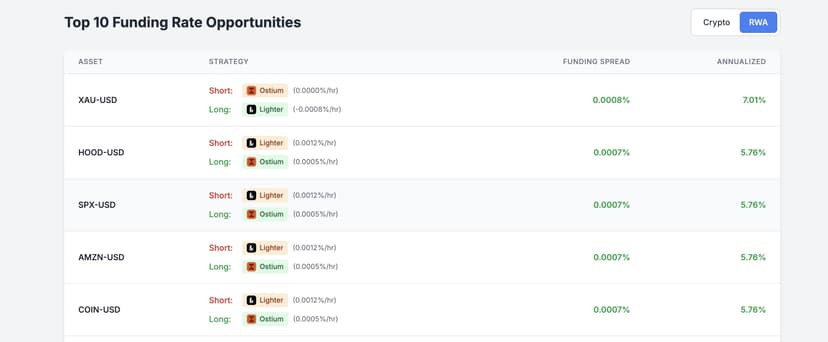

Funding Rate Arbitrage

Capitalize on funding rate differentials between Hyperliquid and other exchanges by:

- Opening opposing positions across platforms

- Collecting funding while maintaining delta-neutral exposure

Liquidity Provision

Place passive orders on both sides of the book to:

- Earn maker rebates

- Capture bid-ask spread

- Provide valuable liquidity to the ecosystem

Cross-Asset Strategies

Utilize the unified collateral system to:

- Execute pairs trades with minimal capital requirement

- Hedge positions across correlated assets

- Optimize capital efficiency across your portfolio

Risk Considerations

While Hyperliquid offers significant advantages over traditional exchanges, users should be aware of:

- Smart Contract Risk: Though audited, all blockchain systems carry inherent smart contract risk

- Liquidation Mechanics: Understand how the auto-deleveraging and liquidation processes work

- Oracle Dependence: Price feeds rely on decentralized oracles for accurate market data

- Market Impact: During volatile periods, slippage may be higher than on larger centralized venues

The Future of Hyperliquid

For the latest updates on Hyperliquid's roadmap and developments, follow their official Twitter account.

As blockchain-based finance continues to evolve, Hyperliquid is positioned to:

- Expand available markets and instruments

- Enhance cross-chain interoperability

- Develop more sophisticated financial primitives

- Foster an ecosystem of third-party applications

With its purpose-built architecture and focus on performance, Hyperliquid represents a glimpse into what the future of decentralized finance might look like: high-performance, transparent, and accessible to all.